KNAV | Assurance Over Emerging Forms of External Reporting: A UK Perspective

Share this page

In an era marked by rapid technological advancements and shifting stakeholder expectations, the landscape of external reporting is undergoing a significant transformation. Traditionally dominated by financial statements, the scope of external reporting in the UK and globally is expanding to include integrated, sustainability, and non-financial reporting. This article delves into the implications of these emerging reporting forms for assurance practices, focusing on the UK context and its stakeholders.

Devendra Kankonkar

Partner - UK

Emerging Forms of External Reporting

The emergence of new reporting forms is a response to a growing demand for transparency and accountability from businesses. Integrated reporting, which combines financial and non-financial data to provide a holistic view of a company’s performance, is gaining traction. Similarly, sustainability reporting, which focuses on environmental, social, and governance (ESG) factors, is becoming increasingly important. These emerging forms are driven by stakeholders’ desire for a more comprehensive understanding of a company’s operations, beyond traditional financial metrics.

Implications for Assurance

These new forms of reporting present unique challenges for assurance providers. Unlike financial reporting, which has well-established standards and practices, the landscape for integrated and sustainability reporting is still evolving. This lack of standardization makes it challenging for auditors to provide assurance on these reports.

Moreover, providing assurance on these new forms of reporting requires auditors to possess a broader skill set. They need to understand sustainability issues, ESG metrics, and Impact of such factors on financial performance. This shift necessitates a transformation in assurance practices, including training and conceptualisation.

Impact on Stakeholders in the UK

The evolving nature of external reporting has significant implications for various stakeholders in the UK.

Regulatory Perspective

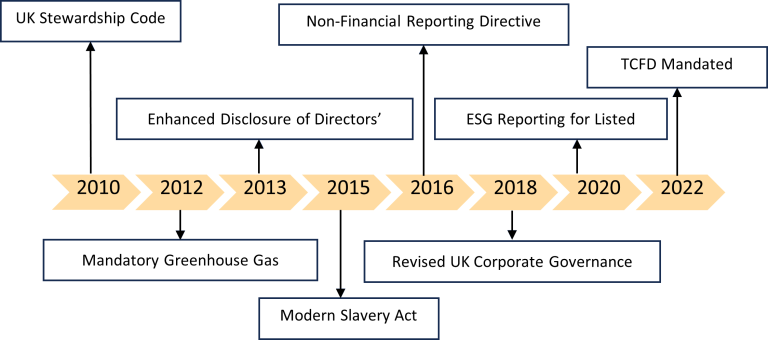

UK regulatory bodies, such as the Financial Reporting Council (FRC), are actively working to adapt to these changes. They are developing guidelines and frameworks to standardize new reporting forms, ensuring that they meet the required level of Vigour and reliability.

Corporate Perspective

UK companies are increasingly adopting these new forms of reporting. This shift is not without challenges, as companies must develop new systems and processes to collect and report a wider range of data. However, those who adapt effectively can reap benefits in terms of enhanced reputation and stakeholder trust.

Investors and Public Interest

For investors and the general public, these new reporting forms offer a more comprehensive view of a company’s performance and risks. Such enhanced transparency can lead to more informed decision-making and increased trust in businesses.

Case Studies and Examples

Several UK-based companies serve as exemplary cases of successful adaptation to new reporting forms. For instance, a leading British multinational consumer goods company has been recognised for its integrated reporting, which effectively communicates its strategy, governance, and performance.

In contrast, an international comparison with a US-based technology firm reveals different challenges and approaches, highlighting the UK’s unique regulatory and business environment.

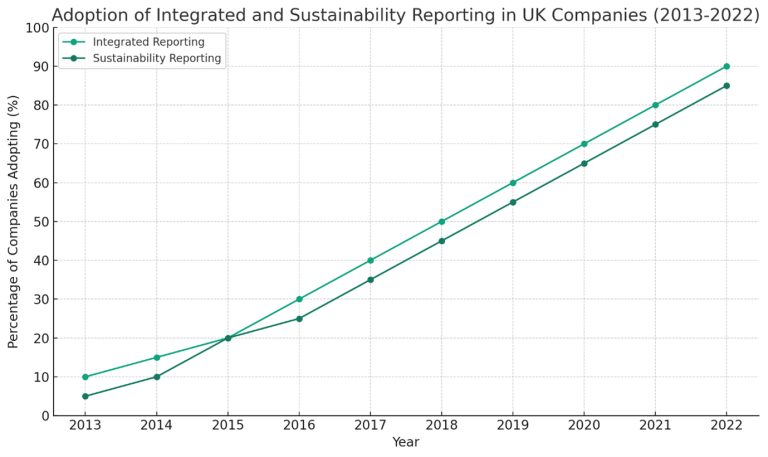

Graph 1: demonstrating the hypothetical increase in the adoption of integrated and sustainability reporting among UK companies over the past decade, from 2013 to 2022. The graph shows a steady rise in the percentage of companies adopting each type of reporting, illustrating a significant shift towards more comprehensive and sustainable business practices in the UK corporate sector.

Table: This table indicates a growing preference for comprehensive reporting, particularly integrated and sustainability reporting, across various stakeholder groups. While traditional reporting still holds importance, there’s a clear shift towards more holistic forms of reporting that encompass financial, environmental, and social aspects of business performance.

Conclusion

The shift towards new forms of external reporting in the UK is a response to changing stakeholder expectations and the evolving business environment. While this transition presents challenges, particularly in terms of assurance practices, it also offers opportunities for enhanced transparency and stakeholder engagement. As UK companies and regulators navigate these changes, the future of external reporting seems poised to become more inclusive, comprehensive, and reflective of a broader range of business impacts.

References

This article references a range of sources, including regulatory guidelines from the FRC, industry reports on emerging trends in external reporting, and academic research on the implications of these trends for assurance practices.